Jaiprakash Power Ventures Limited (JP power share price) has emerged as one of the hottest stocks in the Indian market this week, delivering spectacular returns to investors. The stock jumped 15% on Wednesday, November 19, 2025, and continued its rally with another 12% surge on Thursday, gaining approximately 29% in just two trading sessions. This remarkable momentum follows creditors of its associate company, Jaiprakash Associates Ltd, unanimously voting in favor of Adani Enterprises Ltd’s resolution plan.

The power sector stock has captured significant investor attention, with trading volumes skyrocketing beyond normal levels. Moreover, despite recent controversies surrounding the promoter group, JP Power’s standalone operations continue to demonstrate resilience with consistent profitability and debt reduction efforts.

Current JP Power Share Price Performance

Today’s Trading Activity

JP Power is currently trading around ₹18.70, with a market capitalization of approximately ₹12,830 crore. However, the stock witnessed dramatic movements this week. On November 19, 2025, the share price reached ₹20.35 at 2:10 PM IST, marking a 15.36% increase over the previous closing price of ₹17.64.

Furthermore, on November 20, the stock opened gap up at ₹21.30 and surged to touch an intraday high of ₹22.80, representing a 12.26% gain from the previous close. This exceptional price action has pushed the stock significantly higher from its recent lows.

Volume and Market Activity

The trading activity has been nothing short of extraordinary. JP Power’s stock recorded heavy trading volume with around 7.12 crore shares changing hands, substantially exceeding normal trading patterns. Additionally, this figure was way more than the two-week average volume of 32.09 lakh shares, with turnover on the counter reaching ₹140.89 crore.

Historical Performance Metrics:- JP power share price

Recent Price Trends:

- 1 Month Return: JP Power share price moved up by 13.50% on BSE in the last month

- 3 Months Return: The share price increased by 6.16% over the last three months

- 1 Year Return: The stock delivered 21.94% returns in the last 12 months

- 3 Year Return: JP Power has generated remarkable 178.25% returns over three years, significantly outperforming the Sensex’s 37.31% return

52-Week Range:

- 52-Week High: ₹27.70

- 52-Week Low: ₹12.36

Notably, the 52-week high of ₹27.70 was hit earlier amid Adani acquisition rumors, demonstrating how corporate developments have historically driven this stock.

Latest JP Power News and Developments

Adani Group Wins Jaiprakash Associates Bid

The most significant catalyst behind JP Power’s recent rally is the Adani Group’s successful bid for Jaiprakash Associates. Creditors unanimously voted in favor of Adani Enterprises Ltd’s resolution plan after an electronic auction held in September, where Vedanta had initially emerged as the highest bidder with a ₹17,000 crore offer.

However, lenders ultimately opted for Adani Enterprises, with higher upfront payments cited as the key factor behind the selection. This strategic decision prioritized immediate cash recovery over total deal value.

Why Adani Beat Vedanta:- JP power share price

According to market sources, Adani’s net present value (NPV) was roughly ₹500 crore lower than Vedanta’s, but the accelerated cash flow tipped the scales. Lenders, dealing with delayed recoveries for years, valued the quicker repayment timeline offered by Adani Group.

Specifically, Adani’s ₹12,500 crore upfront offer, coupled with a two-year repayment plan for residuals, outmaneuvered Vedanta’s higher nominal bid of ₹17,000 crore. Additionally, Adani received the maximum 89% votes from creditors, followed by Dalmia Cement (Bharat) and Vedanta Group.

Enforcement Directorate Arrests Promoter

In a contrasting development that initially dampened sentiment, on November 13, 2025, the Enforcement Directorate (ED) arrested Manoj Gaur, the former Managing Director of Jaypee Infratech and a key promoter figure tied to the JP Group, in connection with a ₹14,599 crore money laundering scandal.

Consequently, this arrest triggered an immediate 0.99% plunge in JP Power shares, closing at ₹17.76 on the NSE. The investigation revealed allegations under the Prevention of Money Laundering Act (PMLA), with a Delhi court deeming the charges “serious” and highlighting how Gaur allegedly prioritized group cross-subsidization over buyer obligations.

Nevertheless, despite this negative news, the company emphasized that operations remain unaffected by the promoter-level issues.

JP Power Financial Performance and Fundamentals

Quarterly Results Analysis

JP Power has demonstrated mixed financial performance in recent quarters. Net profit declined 0.31% to ₹182.10 crore in the quarter ended September 2025 compared to ₹182.66 crore during September 2024, while sales rose 17.28% to ₹1,438.30 crore from ₹1,226.41 crore.

However, looking at the first quarter, net profit fell 20.20% to ₹278.13 crore in the quarter ended June 2025 compared to ₹348.54 crore in June 2024, while sales declined 9.78% to ₹1,583.16 crore from ₹1,754.70 crore.

Key Financial Ratios:- JP power share price

| Metric | Value | Significance |

| Market Cap | ₹12,830 Cr | Mid-cap power company |

| P/E Ratio | 18.81 (Standalone) / 18.74 (Consolidated) | Moderate valuation |

| P/B Ratio | 1.16 – 1.27 | Trading above book value |

| EPS | ₹1.08 | Earnings per share |

| ROE | 6.17% | Return on equity |

| Dividend Yield | Not specified | – |

| Beta(1-Year) | 1.1 | Average volatility |

Importantly, JP Power is considered very attractive and undervalued with a PE ratio of 16.28 and a PEG ratio of 0.00, showing strong potential despite recent stock price volatility.

Business Operations Overview:- jp power news

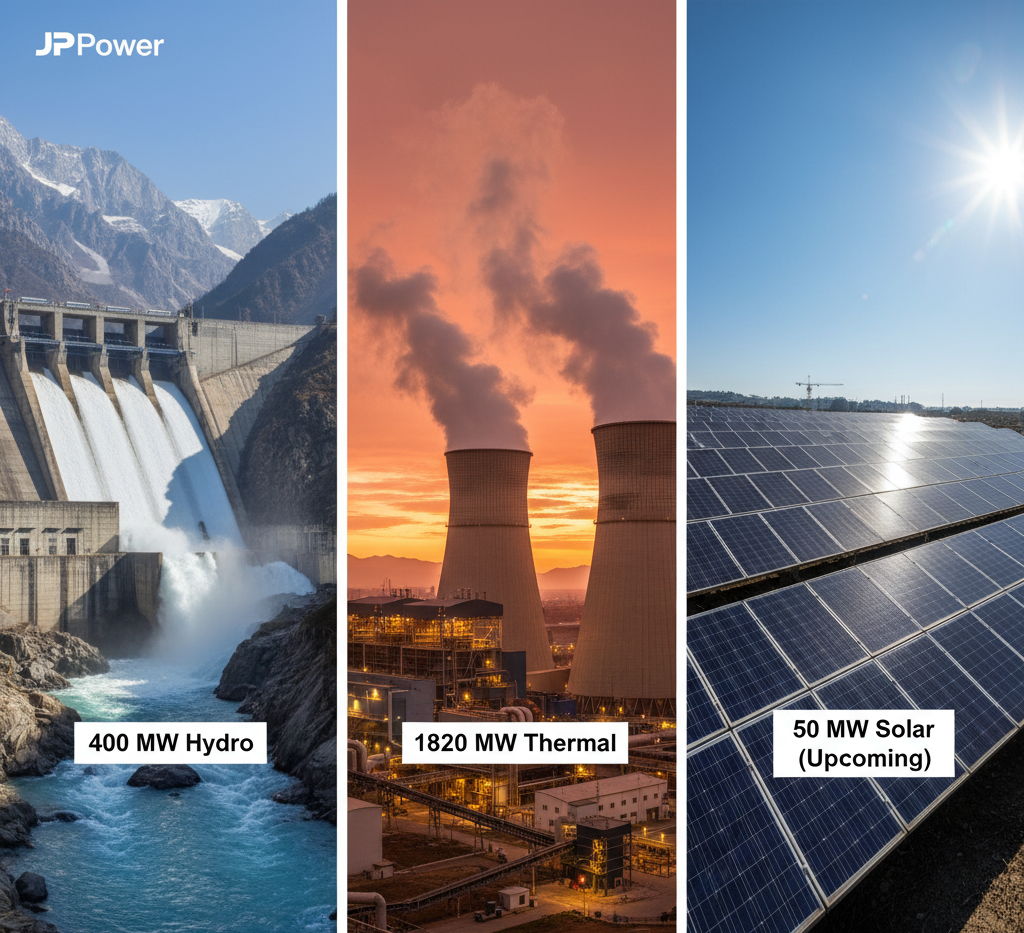

Incorporated in 1994, Jaiprakash Power Venture Limited operates in coal mining, sand mining, cement grinding, and production of thermal and hydroelectric electricity.

Power Generation Capacity:

- 400 MW Vishnuprayag Hydro-Electric Plant in Uttarakhand (operational since October 2007)

- 500 MW Jaypee Bina Thermal Power Plant in Madhya Pradesh with two 250 MW units (operational since August 2012 and April 2013)

- 1320 MW Jaypee Nigrie Supercritical Thermal Power Plant in Madhya Pradesh with two 660 MW units (operational since September 2014 and February 2015)

Future Growth Initiatives

The company is expanding into renewable energy. In a meeting held on August 27, 2025, the board considered a proposal for establishing a 50 MW solar PV project at the company’s existing 500 MW Jaypee Bina Thermal Power Plant, with an estimated investment of around ₹300 crore. This strategic move signals diversification while leveraging existing infrastructure.

READ MORE:- US Stocks Investment Analysis – October 2025

Investment Analysis and Stock Outlook

Bullish Factors:- jp power news

Strategic Value from Adani Deal:

- A successful Adani takeover could unlock value through de-pledging of shares, injecting fresh capital, as JP Associates owns 24% of JP Power’s equity, much of it pledged at 72.9%

- Potential operational synergies with Adani’s expanding power portfolio

- Improved corporate governance under new management

Strong Operational Performance:

- Consistent power generation from diversified assets

- Debt reduction efforts showing progress

- Expansion into renewable energy sector

Valuation Attractiveness:

- The company is currently deemed undervalued, supported by a PE ratio of 16.28, an EV to EBITDA ratio of 7.68, and a Price to Book Value of 0.95

- Trading below its 52-week high provides upside potential

Risk Factors

Promoter-Level Issues:

- Ongoing ED investigation and arrest of key promoter

- Legacy issues from Jaypee Infratech insolvency

- Potential contagion effect on sentiment

Market Volatility:

- High beta indicates above-average price swings

- Dependent on corporate action outcomes

- Regulatory approval pending for Adani deal

Shareholding Structure:

- As of September 2025, promoters held 24% stake in the firm

- Retail investor holdings remain substantial but volatile

Expert Recommendations:- jp power share price bse

Investment experts suggest different strategies based on risk appetite: Long-term investors should accumulate on dips below ₹18, short-term traders should wait for clarity post JAL Committee of Creditors voting, while risk-averse investors should stay on sidelines until dust settles.

Technical Analysis and Trading Patterns

Moving Average Analysis

JP Power stock traded above its 5-, 10-, 20-, 30-, 50-, 100-, 150-day and 200-day simple moving averages (SMAs), indicating strong bullish momentum across all timeframes. This technical strength suggests sustained upward pressure.

Chart Patterns and Trends

Analysts have identified several bullish patterns. Technical analysis shows breakout potential, with targets of ₹30 and ₹42 if the stock breaks above its triangle consolidation pattern from February 2024 high. Moreover, the golden zone drawn from swing low to swing high indicates potential reversal points for swing traders.

Volume-Price Relationship

The unusual surge in trading volumes accompanying price increases confirms strong buying interest rather than mere speculation. Institutional participation appears to be increasing alongside retail enthusiasm.

Shareholding Pattern and Corporate Governance

Current Shareholding Structure:- jp power share price bse

- Promoter Holding: 24.00% (unchanged from December 2024)

- Retail Investors: Significant presence but declining from 76.79% to 67.53% in latest quarter

- Institutional Investors: Growing interest amid corporate restructuring

Pledged Shares Concern

A significant portion of promoter shares remains pledged, creating potential overhang. However, the Adani deal could address this concern through de-pledging initiatives.

Board and Management

The company operates under professional management with lender oversight following the 2019 debt restructuring. Key management includes Mahesh Chaturvedi as Company Secretary & Compliance Officer and Vandana R. Singh as Independent Director.

Peer Comparison and Sector Performance

Power Sector Peers:- jp power share price bse

JP Power competes with several established players in the power generation space:

- NTPC Limited – Government-owned thermal power giant

- Tata Power Company – Diversified private sector player

- SJVN Limited – Hydro power specialist

- Adani Power – Fast-growing private thermal power producer

- JSW Energy – Integrated power and renewable energy company

Competitive Positioning

Compared to peers, JP Power offers:

- Lower valuation multiples

- Diversified generation mix (thermal + hydro)

- Potential turnaround story with Adani backing

- Higher risk-reward profile

Future Catalysts and Expected Developments

Near-Term Catalysts

- NCLT Approval: Final approval for Adani’s resolution plan

- Stake Acquisition: Formal transfer of JP Associates’ 24% stake

- De-pledging Exercise: Release of pledged promoter shares

- Solar Project Approval: Progress on 50 MW renewable energy initiative

Medium-Term Growth Drivers

- Integration with Adani’s power portfolio

- Improved credit profile and lower borrowing costs

- Enhanced operational efficiency under new management

- Expansion into renewable energy segment

Long-Term Strategic Value

The company’s existing 2,220 MW installed capacity, combined with potential synergies from Adani’s infrastructure and distribution network, positions JP Power for sustainable growth in India’s expanding power sector.

Frequently Asked Questions (FAQs)

Q1: What is JP Power today’s share price?

JP Power share price was ₹20.35 at 2:10 PM IST on November 19, 2025, up by 15.36% over the previous closing price of ₹17.64. However, the stock has shown significant volatility, with prices ranging between ₹17.60 and ₹22.80 during recent trading sessions.

Q2: Why did JP Power share price surge recently?

The surge followed news that creditors of its associate company, Jaiprakash Associates Ltd, unanimously voted in favor of Adani Enterprises Ltd’s resolution plan, with higher upfront payments being the key deciding factor. This development created positive sentiment about potential value unlocking and operational improvements.

Q3: Is JP Power a good investment right now?

JP Power presents a high-risk, high-reward opportunity. The stock is considered very attractive and undervalued with a PE ratio of 16.28 and has delivered a remarkable 141.31% return over the past three years, significantly outperforming the Sensex. However, investors should consider promoter-level issues and market volatility before investing.

Q4: How has the promoter arrest affected JP Power operations?

Despite the ED arrest of Manoj Gaur on November 13, 2025, in connection with a ₹14,599 crore money laundering case, the company has clarified that operations remain unaffected. JP Power functions independently under professional management with lender oversight following the 2019 debt restructuring.

Q5: What is the target price for JP Power shares?

While official target prices vary among analysts, technical analysis suggests potential targets of ₹30 and ₹42 if the stock breaks above its triangle consolidation pattern. However, these targets depend on successful completion of the Adani deal and overall market conditions. Investors should conduct thorough research before making investment decisions.

Conclusion

JP Power stands at a critical juncture in its corporate journey. The remarkable 29% surge in just two trading days reflects market optimism about the Adani Group’s potential acquisition of Jaiprakash Associates. While promoter-level controversies create short-term headwinds, the company’s standalone fundamentals remain robust with consistent profitability, diversified power generation assets, and strategic expansion into renewable energy.

The stock’s technical strength, trading above all major moving averages, combined with attractive valuations and undervalued metrics, makes it appealing for risk-tolerant investors. However, the pending NCLT approval, resolution of promoter issues, and successful completion of the Adani deal remain crucial factors that will determine JP Power’s trajectory.

For conservative investors, waiting for clarity on these developments makes sense. Meanwhile, aggressive investors with higher risk appetite might find the current levels attractive for gradual accumulation. As always, investors should align their decisions with their financial goals, risk tolerance, and investment horizon while keeping track of ongoing corporate developments and quarterly results.

The power sector’s long-term growth prospects in India, combined with potential operational synergies under Adani’s management, could transform JP Power into a compelling turnaround story. Nevertheless, prudent portfolio allocation and continuous monitoring remain essential for navigating this volatile yet potentially rewarding investment opportunity.